Working in IT, you hear "AI transformation" applied to everything from chatbots to coffee machines. But in government public services - particularly tax and revenue administration - the transformation is real, measurable, and already delivering results that would make most enterprise AI projects jealous.

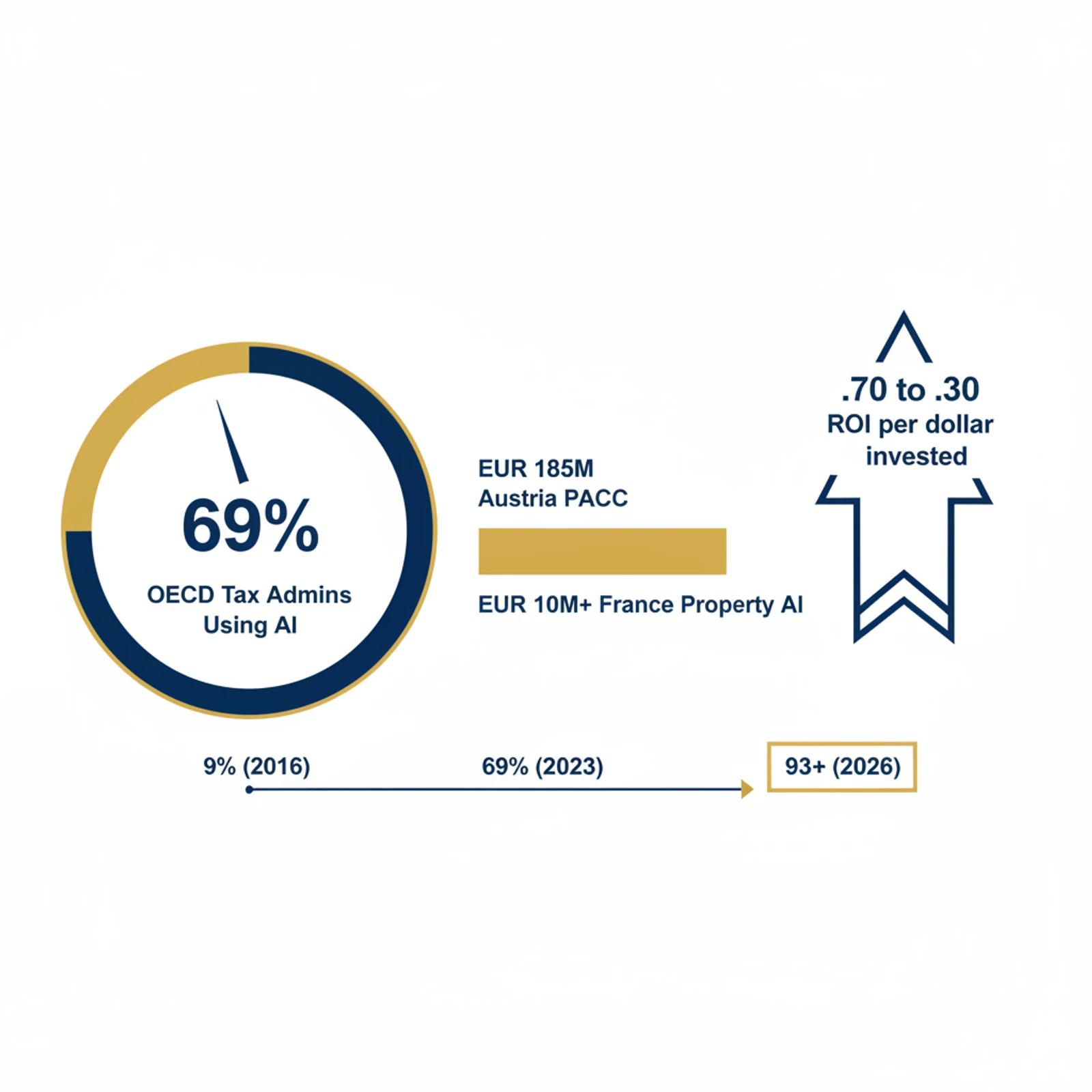

One European tax authority went from basic online filing to AI-powered risk profiling, LLM-assisted legislation analysis, and a 98% query routing accuracy - all while keeping humans firmly in the loop. Their story isn't unique. Across the OECD, 69% of tax administrations now use AI, up from just 9% in 2016. That's not hype. That's adoption at scale.

If you're an IT professional who hasn't worked in risk management before, this might feel like unfamiliar territory. Don't worry. The technology underneath is the same stack you already know - machine learning, NLP, data pipelines, APIs. The domain just happens to be one where the ROI is exceptionally clear.

Let's explore what's actually happening, why it works, and what makes this space worth your attention.

Why Government Public Services? Why Now?

Three forces are converging to make AI in public services not just viable but necessary.

The data is already there. Tax authorities have been collecting structured digital data for decades. One European revenue body moved online in 2000 - that's 25+ years of transaction histories, filing records, and compliance data. Most enterprises would kill for datasets this comprehensive.

The workforce challenge is real. Across OECD countries, 28% of tax administration staff are aged 55 or older. In-person taxpayer contact has declined 56% since 2014. Agencies need to do more with fewer people, and they need to do it now.

The ROI is proven. Early adopters of generative AI in government report $3.70 in value for every $1 invested. Top performers see $10.30 per dollar. When Austria's predictive analytics team generated EUR 185 million in additional tax revenue from AI-driven case analysis, that conversation moved from "should we invest?" to "how fast can we scale?"

Use Case 1: Smarter Risk Profiling

This is where most tax authorities start, and where the biggest efficiency gains live.

The old way: Analysts manually review returns against rule-based thresholds. Flag anything above X deduction or below Y income. The problem? Too many false positives, too many genuine cases missed, and analysts drowning in volume.

The AI way: Machine learning models analyze millions of returns simultaneously, considering hundreds of variables - filing history, industry patterns, peer comparisons, timing anomalies, cross-referenced third-party data. Each case gets a risk score. Analysts focus on the highest-scoring cases first.

Real results:

| Organization | What They Did | Outcome |

|---|---|---|

| Austria's PACC | ML risk scoring across tax sectors | EUR 185M additional revenue, 6.5M cases analyzed (2023) |

| US IRS | ML-based return review program | 40% increase in fraud detection, USD 120B AI-assisted revenue (2024) |

| The Netherlands | AI risk allocation scoring | Taxpayers sorted by non-compliance probability for targeted review |

| France | Satellite imagery + AI for property tax | 140,000 undeclared properties found, EUR 10M+ recovered |

The key insight for IT professionals: these systems aren't making decisions. They're prioritizing work. A human analyst still reviews every flagged case. The AI simply ensures the analyst is looking at the right cases first - which turns out to be enormously valuable when you're processing millions of returns.

Austria's Predictive Analytics Competence Centre (PACC) is worth studying. Organized into four subject areas - Predictive Analytics, Advanced Analytics, Tax Analytics, and Customs Analytics - it analyzed 6.5 million cases in 2023 and flagged 375,000 for further review. The additional revenue generated: approximately EUR 185 million. That's a clear, audited number from a single year.

Use Case 2: LLMs in the Public Sector (Yes, Really)

This is where things get genuinely interesting. Large language models aren't just for chatbots - government agencies are finding surprisingly practical applications.

Internal knowledge retrieval. One European tax authority deployed an AI assistant to all 7,000 staff members, trained on over 1,500 tax and duty manuals plus consolidated legislation notes. Staff ask natural-language questions about complex tax issues and get instant, sourced answers. Think of it as a domain-specific RAG system built on decades of institutional knowledge.

Legislative stress-testing. Perhaps the most creative use case: feeding draft legislation into AI models and asking them to find weaknesses. As one official described it - the system probes legislation for loopholes, avoidance strategies, and evasion opportunities that tax advisers might exploit. This isn't replacing legal expertise. It's giving legal experts a powerful new tool for pressure-testing their work before it goes live.

Document processing at scale. AI drafts initial versions of tax manuals using legislation and ministerial notes as inputs. It extracts common themes from public consultation responses. It summarizes complex High Court judgments. Each output gets human review - but the first draft is done in minutes instead of days.

Customer query routing. Replacing traditional dropdown menus with free-text AI analysis improved query routing accuracy from 70% to 98% at one authority. That's the difference between a taxpayer reaching the right department on the first try versus bouncing around the system.

What's coming next: AI-powered call centers where callers describe their issue while waiting in the queue. By the time a handler picks up, they've already received an AI-generated briefing and suggested responses. The caller gets faster resolution. The handler spends less time on context-gathering. Everyone wins.

Use Case 3: Taxpayer-Facing Services

AI isn't just an internal efficiency tool. It's fundamentally changing how citizens interact with government services.

Chatbots that actually work. Singapore's tax authority deployed an AI chatbot that handled 70,000 transactional queries in a single fiscal year, saving an estimated 11,666 taxpayer hours and cutting call center inquiries by 50%. The key? It uses LLMs for multilingual resolution and routes sensitive inquiries to human agents. That balanced approach helped achieve a 30% increase in voluntary compliance rates within two years.

Pre-populated returns. Nearly 90% of personal income tax returns across the OECD are now filed electronically, and AI is increasingly pre-filling fields using data from employers, banks, and other third parties. The taxpayer reviews and confirms rather than entering everything from scratch.

Personalized guidance. Greece is developing an LLM-powered digital assistant that provides advisory support during income tax return submission. Not a FAQ page. Not a decision tree. An actual conversational assistant that understands context.

For IT teams, the architecture behind these services is familiar: NLP pipelines, retrieval-augmented generation, intent classification, escalation routing. The domain complexity is in the tax rules, not the technology stack.

Use Case 4: The Satellite Imagery Story

This one deserves its own section because it's such a vivid example of AI finding value where humans simply can't look.

France's tax authority partnered with Capgemini and Google to analyze satellite imagery of residential properties. AI models scan aerial photos, identify features like swimming pools, building extensions, and outbuildings, then cross-reference them against property tax declarations.

The results speak for themselves:

- Over 140,000 undeclared properties identified by 2023

- 94% accuracy - nearly all flagged cases confirmed as genuinely undeclared

- EUR 10 million+ in additional tax revenue from the initial phase

- Human review on every flagged case to catch the 6% false positives (blue tarps that look like pools, etc.)

Greece found something even more striking. In one area, official records listed 324 swimming pools. AI analysis found 16,974.

The technology is computer vision - object detection models trained on aerial imagery, with change detection algorithms comparing snapshots over time. For property tax, this means any modification to a property (new construction, extensions, converted land use) can be detected and cross-referenced against filed declarations.

The Governance Framework (Don't Skip This Part)

If you're thinking "this sounds powerful but also risky" - you're right, and the regulators agree.

The EU AI Act (Regulation EU 2024/1689) is the first comprehensive legal framework for AI worldwide. It takes a risk-based approach:

| Timeline | What Takes Effect |

|---|---|

| Feb 2025 | AI literacy obligations |

| Aug 2025 | Governance rules, general-purpose AI model obligations |

| Aug 2026 | Most high-risk AI system requirements |

| Aug 2027 | High-risk AI in regulated products |

The OECD framework specifically addresses AI in tax administration, focusing on transparency, accountability, data quality, privacy, and bias mitigation.

Practical constraints that the leading agencies follow:

- AI tools do not draft legislation directly

- Generative AI is not used for parliamentary questions or public-facing policy documents

- All outputs require human review and validation

- Sensitive queries always escalate to human agents

- Algorithmic decisions must be explainable and auditable

These aren't bureaucratic obstacles - they're design principles. The agencies getting the best results are the ones that treat governance as part of the system, not an afterthought. For IT teams building or integrating AI systems for government clients, understanding these constraints is essential.

The ROI Picture

Let's consolidate the numbers, because this is ultimately a business conversation.

| Metric | Value | Context |

|---|---|---|

| OECD tax admins using AI | 69% (2023), up from 9% (2016) | Massive adoption curve |

| GenAI ROI (early adopters) | $3.70 per $1 invested | Deloitte research |

| GenAI ROI (top performers) | $10.30 per $1 invested | Deloitte research |

| Austria PACC additional revenue | EUR 185M (2023) | Single year, single program |

| France property detection | EUR 10M+ initial, 140K properties found | Expanding nationwide |

| Singapore chatbot savings | 11,666 taxpayer hours, 50% fewer calls | FY2024 |

| IRS AI-assisted revenue | USD 120B (2024), up from USD 20B (2021) | 6x growth in 3 years |

| US fraud detection improvement | 40% increase | ML-based return review |

| Query routing accuracy | 70% to 98% | European tax authority |

| Global gov AI market | USD 22.4B (2024), projected USD 98B by 2033 | 17.8% CAGR |

The collection cost ratio across OECD countries sits at 73 cents per 100 units of revenue collected. Every improvement in targeting, automation, or self-service pushes that ratio down. When your "product" is public revenue, even small percentage improvements translate to enormous absolute numbers.

What This Means for IT Teams

If you're working in or considering a move toward government/public sector AI, here's what the landscape looks like from a technology perspective.

The stack is familiar. Risk scoring uses gradient boosting, random forests, neural networks. Document processing uses RAG architectures with vector databases. Chatbots use intent classification and LLM orchestration. Satellite analysis uses computer vision (YOLO-family, change detection). None of this is exotic.

The data engineering matters more. Government datasets are large, structured, and historically messy. Data quality, lineage, and governance are first-class concerns. If you're good at data pipelines and data quality, this domain needs you.

Explainability is non-negotiable. Every AI-driven decision that affects a citizen must be explainable. This means investing in interpretable models, audit trails, and decision documentation from day one. It's not optional - it's legally required under the EU AI Act for high-risk systems.

Human-in-the-loop is the design pattern. The most successful implementations augment human judgment rather than replacing it. Your system surfaces the insights; the human makes the call. This is both a governance requirement and a design philosophy that builds trust.

The market is growing fast. From USD 22.4 billion in 2024 to a projected USD 98 billion by 2033 - government AI is one of the fastest-growing segments. The aging workforce (28% over 55 across OECD tax administrations) means automation demand will only accelerate.

Getting Started: Practical Advice

Start with the problem, not the technology. The best government AI projects begin with a specific operational pain point - case backlog, manual routing, slow document review - and apply the minimum viable AI to address it.

Study the leaders. Austria's PACC, Singapore's IRAS chatbot, and the European tax authority's RevAssist all follow similar patterns: focused scope, measured rollout, human oversight, iterative improvement.

Understand the governance first. Before writing a line of code, understand the EU AI Act timeline, your jurisdiction's data protection requirements, and the OECD trustworthy AI principles. These shape every architectural decision.

Build for trust. Government AI operates under higher scrutiny than commercial AI. Citizens, politicians, and media all have opinions. Transparency, explainability, and demonstrable human oversight aren't nice-to-haves - they're existential for the program's survival.

Think workforce transformation, not replacement. The agencies seeing the best results frame AI as empowering their existing staff to handle more complex work, not as headcount reduction. One official noted they expect smaller numbers of higher-paid staff as complexity increases alongside automation. That's a very different narrative from "AI is taking jobs."

Wrapping Up

AI in government public services isn't a future promise. It's happening now, at scale, with measurable results. From EUR 185 million in additional revenue through predictive analytics to 98% query routing accuracy through NLP, the numbers tell a compelling story.

What makes this space particularly interesting for IT professionals is the combination of mature data assets, clear ROI metrics, growing market demand, and technology requirements that map closely to mainstream AI/ML skills. The domain knowledge is learnable. The governance frameworks are well-documented. The problems are real and well-defined.

The agencies leading this transformation share a common philosophy: AI as a tool for better public service, not just better enforcement. That means helping citizens file correctly, helping staff find answers faster, and focusing limited resources where they'll have the most impact.

For IT teams, that's a mission worth building for.

Sources: